Posted on June 1, 2019It’s important to take a look at your financial picture to see where you are at at any age but, even more so if you are nearing retirement.

Make a list of steps you need to take to assure that your future actions align with your long-term financial goals.

A

CBIC poll, shows that last year people thought that $756,000 is the average amount that Canadians think they’ll need in order to fund the retirement lifestyle they’d like.

Yet, among those nearing retirement or on the cusp—those aged 45 to 64—of it, 32 percent haven’t saved anything for retirement.

Among those with retirement money stashed away, the average value of their fund is $345,000, though nearly half (49%) have saved less than $250,000.

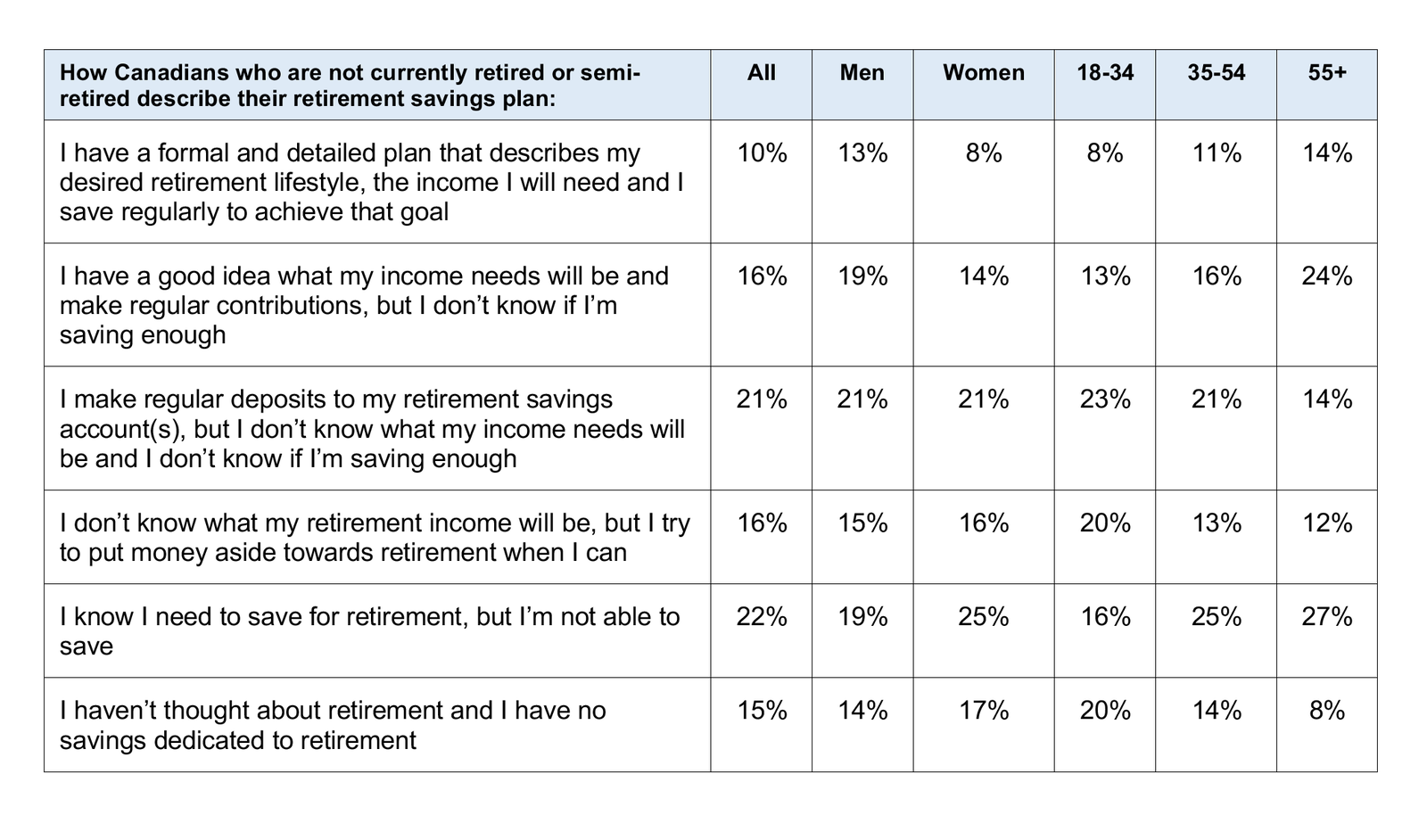

Here’s some data on how Canadians are faring when it comes to taking the steps —like knowing what income retirement needs will be and making regular deposits into retirement accounts— needed to have a shot at a financially healthy retirement.

Prospective Buyers’ Motivators

CMHC talked to first-time buyers, previous owners, and current owners about things like their housing expectations, home purchase drivers, and concerns.

Here are three key findings.

- Key motivators. Improved accessibility (physical obstacles and barriers) and investment opportunity were top motivators among all three groups. The desire to stop renting was a top motivator for both first-time buyers (65%) and previous owners (60%).

- Move-in ready. First-time buyers (43%), previous owners (44%), and current owners (48%) all say an existing move-in-ready home is their top choice. But some are willing to buy a property that requires renovation. That option appeals to 14% of first-time buyers, 11% of previous owners, and 7% of current owners. Some want brand new homes, including first-time buyers (19%), previous owners (21%), and current owners (32%).

- Home purchase prices. More than half of first-time buyers (54%) and previous owners (54%) plan to spend under $300,000 to buy a home, and about 25% intend to spend between $300,000 to just under $500,000.

But just 33% of current owners are planning to spend under $300,000, and 34 percent are looking for options over the half-million dollar range.